Max Simple Ira Contribution 2024 Over 50

Max Simple Ira Contribution 2024 Over 50. Effective january 1, 2024, employers are permitted to make additional contributions to each participant in a simple plan in a uniform manner, provided that the contribution may not exceed the lesser of 10% of compensation or $5,000 (indexed). Irs 401k limits 2024 over 50 kelli madlen, in 2025, the total contribution limit is projected to be $71,000.

Employers may contribute either a flat 2% of your pay, regardless of whether you contribute, or match. The total of all employee and employer contributions per employer will increase from $66,000 in 2023 to $69,000 in 2024 for those under 50.

The 2024 Annual Ira Contribution Limit Is $7,000 For Individuals Under 50, Or $8,000 For 50 Or Older.

Effective january 1, 2024, employers are permitted to make additional contributions to each participant in a simple plan in a uniform manner, provided that the contribution may not exceed the lesser of 10% of compensation or $5,000 (indexed).

414 (V) (2) (B) (Ii);

$6,000 ($7,000 if you’re age 50 or older), or.

Max Simple Ira Contribution 2024 Over 50 Images References :

Source: vickyqrobena.pages.dev

Source: vickyqrobena.pages.dev

Simple Ira Contribution Limits 2024 Irs Elisha Chelsea, 2024 max roth ira contribution over 50. If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000.

Source: juliannwkarry.pages.dev

Source: juliannwkarry.pages.dev

Max 401k Contribution 2024 Over 50 Alexa Marlane, Effective january 1, 2024, employers are permitted to make additional contributions to each participant in a simple plan in a uniform manner, provided that the contribution may not exceed the lesser of 10% of compensation or $5,000 (indexed). The ira contribution limit does not apply to:

Source: shelaqcoraline.pages.dev

Source: shelaqcoraline.pages.dev

Simple Ira Limits For 2024 Elana Virginia, For 2024, the ira contribution limit is $7,000 for those under 50. The 2024 simple ira contribution limit for employees is $16,000.

Source: kelsyqrosina.pages.dev

Source: kelsyqrosina.pages.dev

Roth Ira Max Contribution 2024 Over 50 Fae Kittie, For 2024, the ira contribution limit is $7,000 for those under 50. Roth ira contribution limits 2024 phase out star zahara, if you are 50 or older, your roth ira.

Source: heddabcourtnay.pages.dev

Source: heddabcourtnay.pages.dev

Roth Ira 2024 Contribution Limit Irs Over 50 Brooke Clemmie, Stay up to date with the simple ira contribution limits for 2024. The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000.

Source: edeacorenda.pages.dev

Source: edeacorenda.pages.dev

What Is The Max Simple Ira Contribution For 2024 Elana Harmony, See the chart below for simple ira contribution limits for. Simple ira contribution limits 2025 over 50.

Source: robinawgwynne.pages.dev

Source: robinawgwynne.pages.dev

Maximum Contribution To Ira 2024 Aeriel Tallou, See the chart below for simple ira contribution limits for. The maximum simple ira employee contribution limit is $16,000 in 2024 (an increase from $15,500 in 2023).

Source: fity.club

Source: fity.club

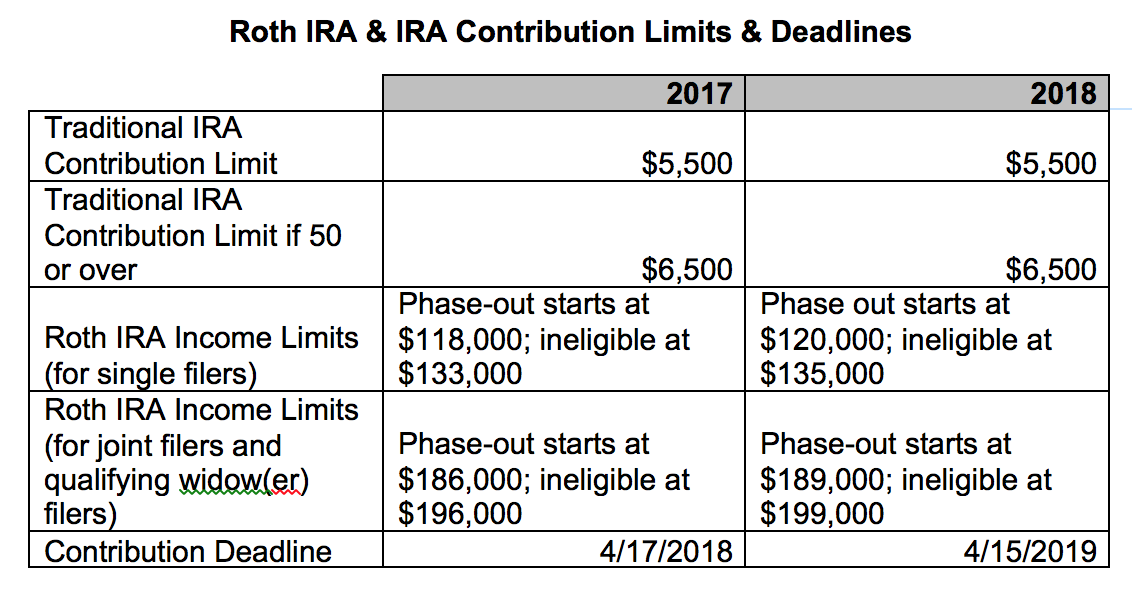

Year End Look At Ira Amounts Limits And Deadlines, Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government's thrift savings plan can contribute up to $23,000 in 2024, a $500 increase from the $22,500 limit in 2023. 2024 401k contribution max over 50 2024 401k contribution max over 50.

Source: darellasalomi.pages.dev

Source: darellasalomi.pages.dev

Ira Contribution Limits 2024 Deadline Sula, $6,000 ($7,000 if you're age 50 or older), or. Those numbers increase to $16,000 and $19,500 in 2024.

Source: caseyqludovika.pages.dev

Source: caseyqludovika.pages.dev

Max Roth Ira Contributions 2024 Libbi Othella, The ira contribution limit does not apply to: That's up from the 2023 limit of $15,500.

The Hsa Contribution Limit For Family Coverage Is $8,300.

The maximum roth ira contribution for.

You Can Make 2024 Ira Contributions Until The Unextended Federal Tax Deadline (For Income Earned In 2024).

This article provides a comprehensive overview of the current limits for individuals and employers.

Posted in 2024