Mileage Per Diem Rate 2024

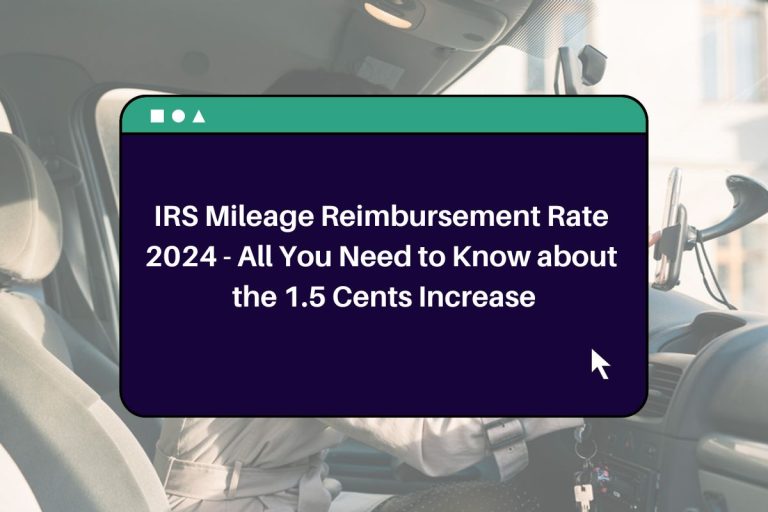

Mileage Per Diem Rate 2024. The general services agency (gsa) has released new rates for reimbursement of privately owned vehicle (pov) mileage for 2024. Mileage reimbursement rates reimbursement rates.

The general services agency (gsa) has released new rates for reimbursement of privately owned vehicle (pov) mileage for 2024. All current nsas will have lodging rates at or above fy 2023 rates.

This Issues With The Approval Of Pr.

Fy 2024 per diem rates for florida.

General Services Administration (Gsa) Travel Info.

The standard conus lodging rate will increase from $98 to $107.

Fy 2024 Per Diem Rates For.

Images References :

Source: higion.com

Source: higion.com

Free Mileage Log Templates Smartsheet (2023), If you are an employer, go to automobile and motor vehicle allowances. General services administration (gsa) travel info.

Source: andreiqsharyl.pages.dev

Source: andreiqsharyl.pages.dev

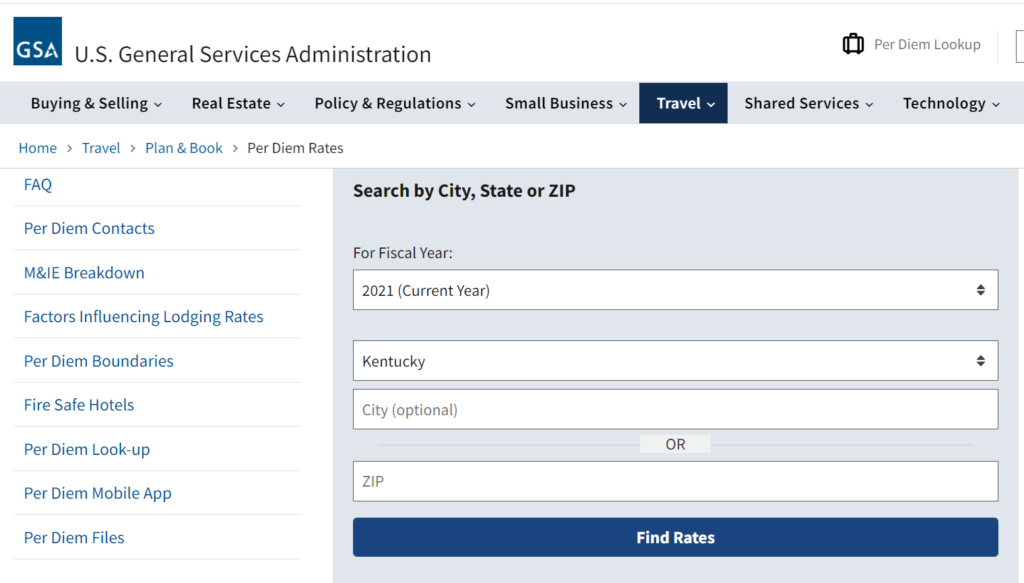

Per Diem Rates 2024 Washington State Tatum Lauryn, Click county for rate sheet. Mileage reimbursement rates reimbursement rates.

Source: timeero.com

Source: timeero.com

IRS Mileage Rate for 2023 What Can Businesses Expect For The, Washington — today, the u.s. This issues with the approval of pr.

Source: www.itilite.com

Source: www.itilite.com

Per Diem Rates in the US All you Need to Know ITILITE, For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Ed davis, program analyst, office.

Source: businesswalls.blogspot.com

Source: businesswalls.blogspot.com

What Is The Average Per Diem Rate For Business Travel Business Walls, The per diem rates shown here for lodging and m&ie are the exact rates set by the gsa. This issues with the approval of pr.

Source: www.mybikescan.com

Source: www.mybikescan.com

2024 IRS Mileage Reimbursement Rate A 1.5 Cent Boost Explained, For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Click county for rate sheet.

Source: matricbseb.com

Source: matricbseb.com

IRS Mileage Reimbursement Rate 2024 All You Need to Know about the 1., Click county for rate sheet. Find current rates in the continental united states, or conus rates, by searching below with city and state or zip code, or by clicking on the map, or use the new per diem tool to.

Source: www.hospitalitynet.org

Source: www.hospitalitynet.org

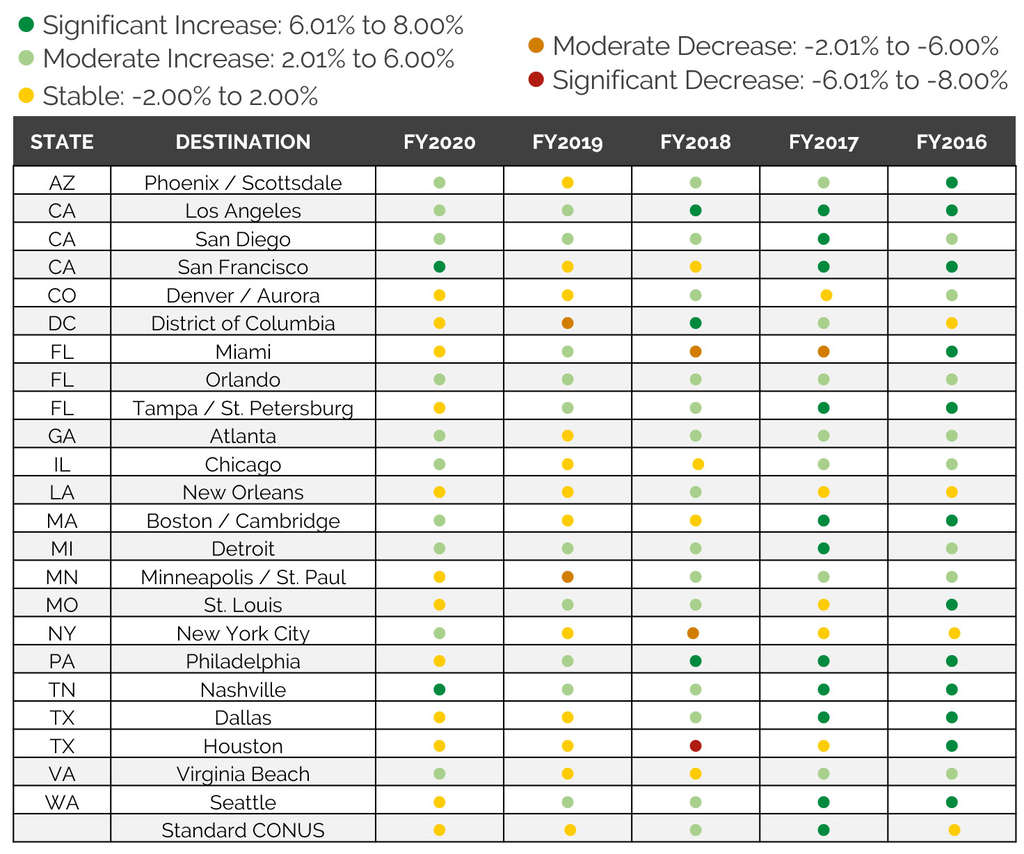

Per Diem Rates Current & Historical Trends By Chelsey Leffet, Car expenses and use of the standard mileage rate are explained in chapter. The per diem rates shown here for lodging and m&ie are the exact rates set by the.

Source: mindyourdecisions.com

Source: mindyourdecisions.com

Making a per diem budget using the simple expense tracker Mind Your, Government per diem 2021 irs mileage rate 2021, fy 2024 per diem rates for illinois. Last updated january 25, 2024.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

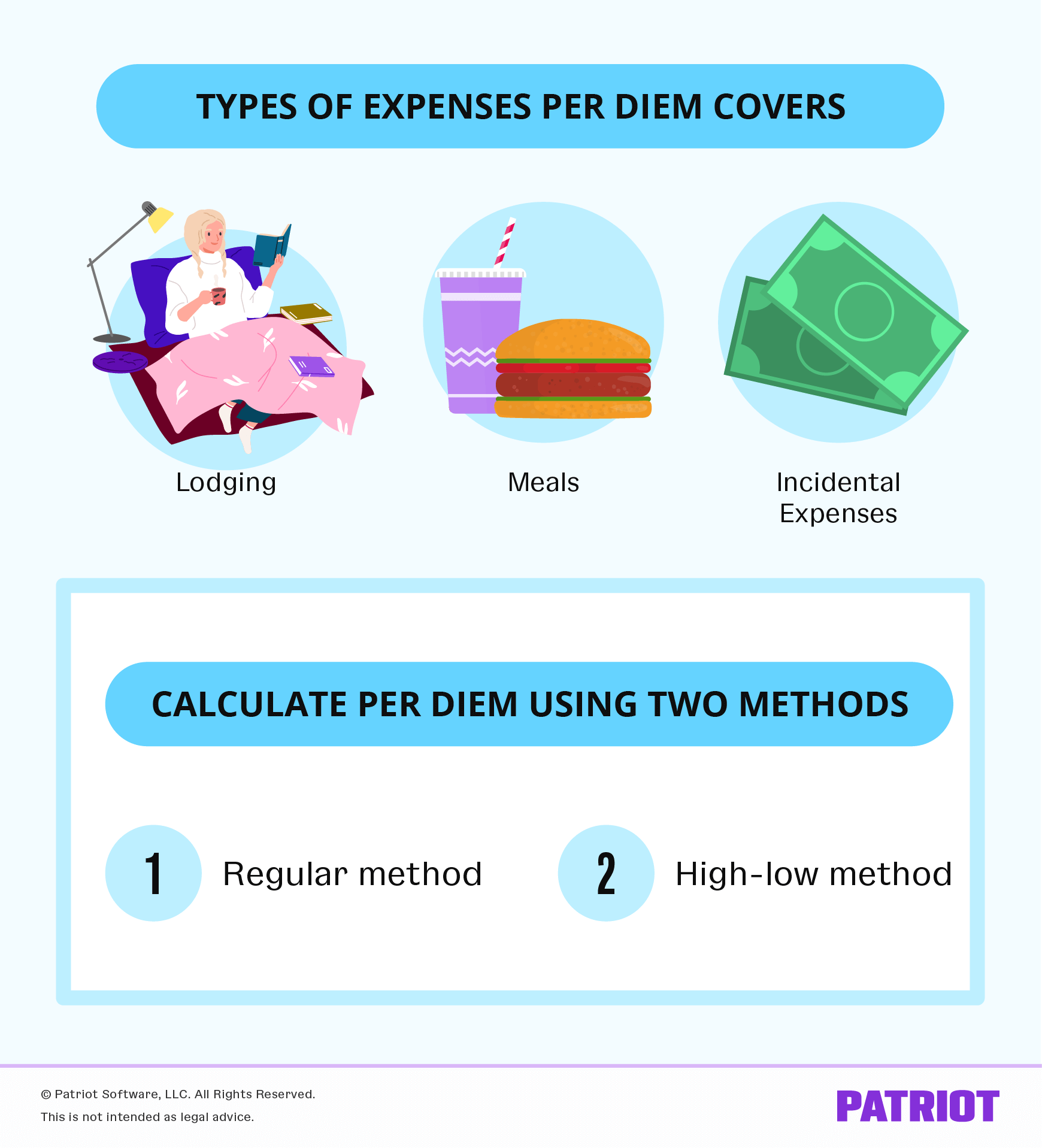

Understanding Publication 1542 Per Diem Rates & Calculations, Download most recent pdf file [48 pages] or use the form to download a zip of. In 2024, the irs set the following rates:

The Per Diem Rates Shown Here For Lodging And M&Amp;Ie Are The Exact Rates Set By The Gsa.

How per diem is calculated;

The Standard Mileage Rates For 2023 Are:

5+ gsa 2023 per diem rates for you 2023 gds, gsa has adjusted all pov mileage reimbursement rates effective january 1, 2024.