Maximum Allowable Gift 2024

Maximum Allowable Gift 2024. What is the 2023 and 2024 gift tax limit? For 2024, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023.

2024 estate, gift, and gst tax exemptions. Gift tax is a federal tax on a transfer of money or property to another person while getting nothing (or less than full value) in return.

For Couples Who Want To Take Advantage Of This Increase, The Limit Doubles To $36,000 Per Recipient.

2024 estate, gift, and gst tax exemptions.

Irs Announces Increased Gift And Estate Tax Exemption Amounts For 2024.

This is known as your annual exemption.

For Married Couples, The Exemption Doubles, Allowing Them.

Images References :

Source: atonce.com

Source: atonce.com

Maximize Your Paycheck Understanding FICA Tax in 2024, The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2024 due to inflation. 2024 estate, gift, and gst tax exemptions.

Source: anna-dianewjessi.pages.dev

Source: anna-dianewjessi.pages.dev

Ss Earning Limit 2024 Beryle Leonore, 2024 lifetime gift tax exemption limit: This means you can give up to $18,000 to as many people as you want in 2024 without any of it being subject to the federal gift tax.

Source: incomunta.blogspot.com

Source: incomunta.blogspot.com

Maximum Limit For Roth Ira, Being aware of the maximum allowable gift amount in 2024 can help you plan your gifts more strategically while also ensuring compliance with tax. Updated per latest interim budget 2024.

Source: fashioncoached.com

Source: fashioncoached.com

Bar Mitzvah Gift Amounts in 2023 Greatest Gift (2024), Gifts are of three types. Most people don’t have to worry about this tax thanks to annual and lifetime exclusions.

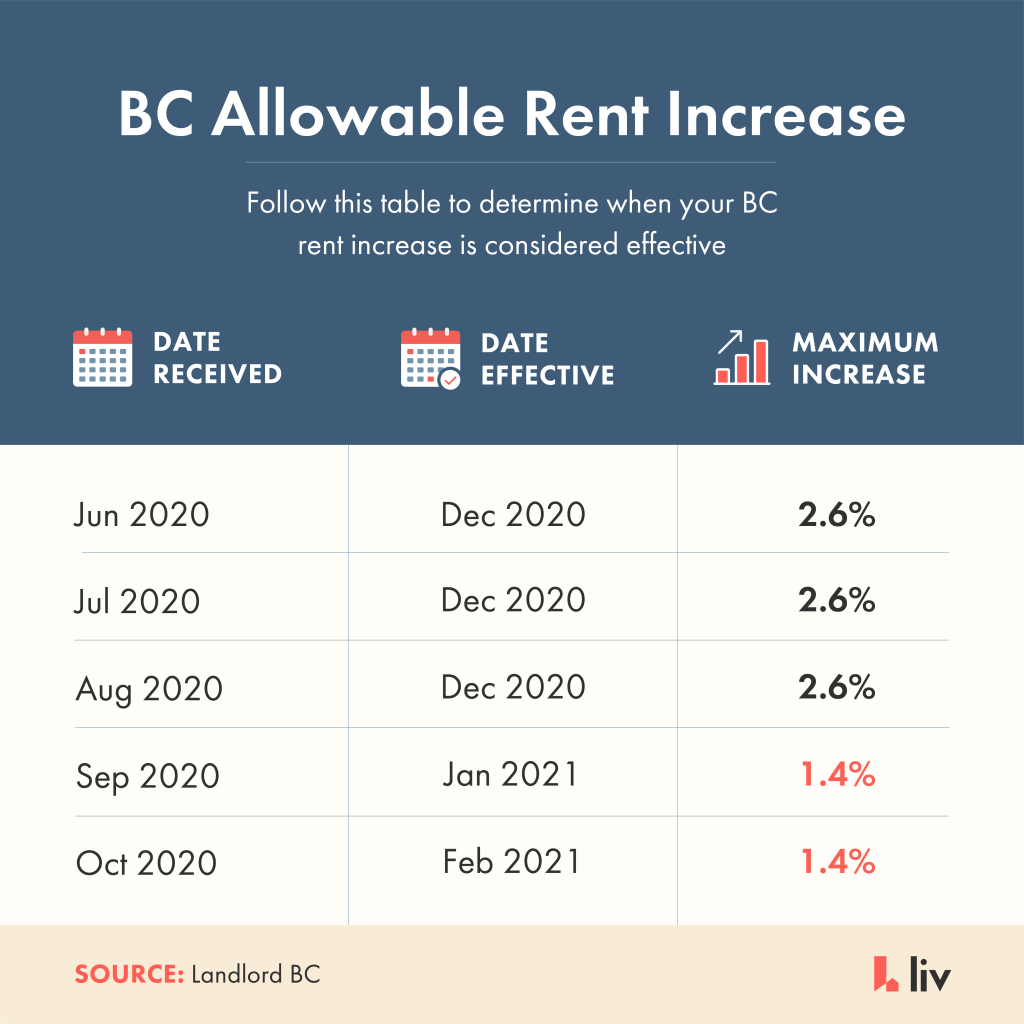

Source: liv.rent

Source: liv.rent

加拿大2021年租金涨幅通知(内附时间表) liv.rent 博客, Gift tax limits for 2022. This is known as your annual exemption.

Source: medicare-faqs.com

Source: medicare-faqs.com

When Is Medicare Disability Taxable, For 2024, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023. (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for.

Source: headtopics.com

Source: headtopics.com

P.E.I. maximum allowable rent increase set at three per cent for 2024, Being aware of the maximum allowable gift amount in 2024 can help you plan your gifts more strategically while also ensuring compliance with tax. Additionally, the lifetime exemption will increase.

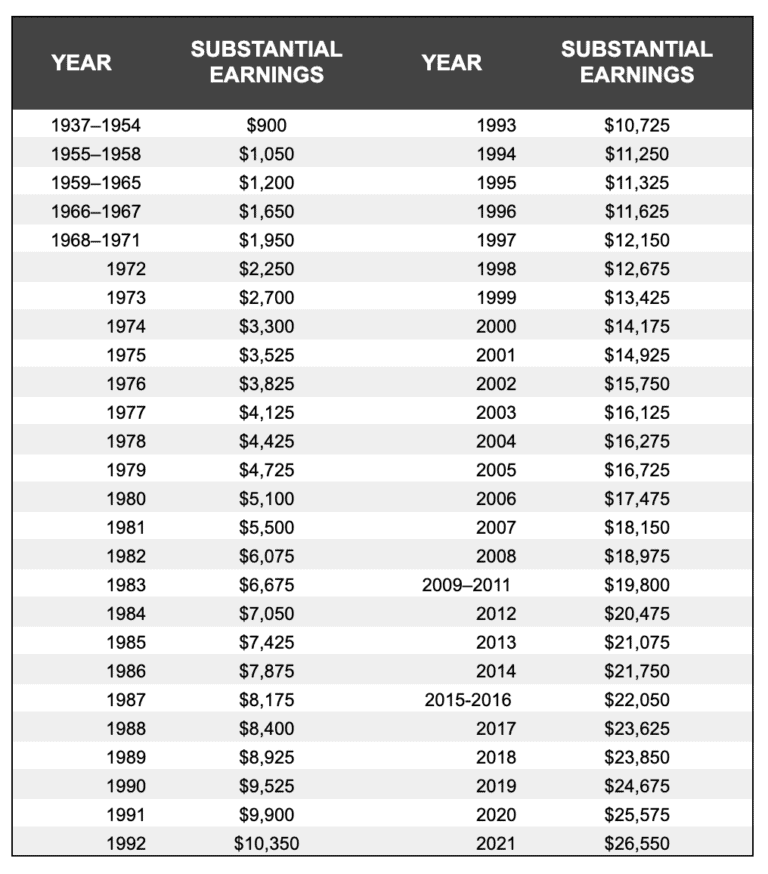

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

Substantial Earnings for Social Security’s Windfall Elimination, For example, you only have to file a gift tax return. Gifts are of three types.

Source: stxaviersschooljaipur.com

Source: stxaviersschooljaipur.com

Sale > american carry on size > in stock, For 2024, the annual gift tax exclusion is $18,000, up from $17,000 in 2023. The annual gift tax exclusion (the amount that may gift to one individual without needing to file a gift tax return) has increased from $17,000 in 2023 to.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Source: brooklalayne.blogspot.com

Source: brooklalayne.blogspot.com

Self employed paycheck calculator BrookLalayne, For 2024, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023. Gift tax limits for 2022.

For Couples Who Want To Take Advantage Of This Increase, The Limit Doubles To $36,000 Per Recipient.

Gift tax limits for 2022.

1.5 Lakh Per Financial Year.

For 2024, the lifetime gift tax exemption is $13.61 million, up from $12.92 million in 2023.